Parents' welfare receipt and their children's employment and education outcomes

Parents' welfare receipt and their children's employment and education outcomes

Snapshot Series – Issue 10

What do we know?

Intergenerational social mobility measures how likely it is for a person's socio-economic circumstances (education, occupation and income) to differ from that of their parents. Australia has historically achieved high social mobility where children from poor backgrounds have markedly improved their socio-economic position. In international benchmarking studies, Australia's social mobility has typically far outranked the United States, and aligns more closely with the rankings of Canada and Sweden (Cobb-Clark, Dahmann, Salamanca, & Zhu, 2022; Deutscher & Mazumder, 2020; Leigh, 2007).1

Australia's tax and welfare systems help to promote mobility. Welfare payments such as Parenting Payments and JobSeeker (previously called Newstart Allowance) are available for Australians unable to earn sufficient income to meet their individual and/or family's needs. However, persistent poverty remains an issue. Many people are on welfare for long periods of time, and the extended receipt of welfare is typically an indicator of entrenched underlying disadvantage.

While welfare payments assist many families, recipients may still face adverse circumstances that affect them and their children. Related research shows an association between children born in the late 1980s/early 1990s who received welfare payments as young adults and their parents receiving welfare while they were growing up (Cobb-Clark et al., 2022). Australian children raised in families with welfare receipt can face challenges in education and/or work outcomes that maintain disadvantage. They often experience lower rates of school attendance, performance and completion, lower rates of employment, more social exclusion, and poorer physical and mental health outcomes (Perales et al., 2014).

Those not in education, employment and/or training (NEET) during adolescence are at risk of poorer outcomes later in life, including lower levels of employment, increased social exclusion, and reduced health and wellbeing (Australian Institute of Health and Welfare [AIHW], 2021; Mitrou, Haynes, Perales, Zubrick, & Baxter, 2021). In New Zealand, long-term NEETs aged 18-19 were 20% less likely to be employed two years later and 10% less likely to have a bachelor's degree four years later (Samoilenko & Carter, 2015). In Ireland, NEET status was associated with a twofold increased risk of anxiety disorders and a sevenfold increased risk of suicidal ideation (Power et al., 2015).

What can we learn?

There has been limited research on the process behind Australia's social mobility - the extent of disadvantage that carries over from parents to children. Evidence is needed to understand how Australian policies, such as the provision of welfare payments, are performing to address intergenerational disadvantage.

Addressing these research gaps, this snapshot uses data from Growing Up in Australia: The Longitudinal Study of Australian Children (LSAC) to answer two research questions: (1) What was the prevalence of welfare receipt among the primary parents of LSAC adolescents as they were growing up? (2) Are adolescents (aged 18-19 years) at higher risk of not being in education, employment or training (NEET) if their primary parent had received welfare payments? If so, does this vary by receipt duration?

In focus

The focus of this snapshot is adolescents aged 18-19 from Wave 8 of the K cohort in LSAC and their education and employment status. This is paired with Centrelink data for the primary parents of the adolescents to examine the frequency and duration of welfare receipt between July 2002 and June 2017, as the adolescents were growing up (ages 2-18). Associations between parents receiving welfare and their children not being in education, employment or training (NEET) at age 18-19 are then explored.

The primary parent is defined as the parent who knows the study child best; in most cases, this is the biological mother. In many households another parent is also present. However, the available data on this parent's welfare receipt were insufficient for the analysis in this snapshot; see the Supplementary Material for further detail. Welfare receipt is defined by receipt of Parenting Payments (Single or Partnered) and Newstart Allowance (JobSeeker) payments. Although some parents received other types of welfare payments, Parenting Payments and Newstart Allowance payments were the most common types (with 67% of parents receiving income support payments receiving one of these). This selection also reflects disadvantage that is not expected to be ongoing/lifelong and so it is reasonable to expect payments to cease when the disadvantage is remedied.2

Receipt categories are: never received welfare; limited receipt of welfare payments totalling up to 3.5 years across July 2002 to June 2017 (the median total duration among recipients, see Supplementary Material Figure S1); or having extended receipt of welfare totalling more than 3.5 years across this period. This is informed by an initial classification tree analysis to identify appropriate cut points.

How prevalent was parental welfare receipt as LSAC adolescents grew up?

Around 30% of primary parents had received at least one of either Newstart Allowance or Parenting Payments across July 2002 to June 2017 (Figure 1). Among recipients, limited and extended receipt of welfare is distinguished at the median total duration of 42 months (3.5 years). LSAC adolescents are categorised by their primary parent's welfare receipt: none (70% of the sample), limited (up to 3.5 years, 15%), and extended (beyond 3.5 years, 15%). Extended receipt is of interest as the prolonged duration may indicate insufficient support in addressing the recipient's underlying disadvantage. The modelling results in this snapshot are not sensitive to this definition, however, since the findings are equivalent when extended receipt is defined as more than one, five, or seven total years across July 2002 to June 2017.

Figure 1: Prevalence of primary parent's welfare receipt

Notes: Payment categories across July 2002 to June 2017. Values are unweighted. (n = 2,580)

Source: Centrelink income support payments information linked to the LSAC survey data

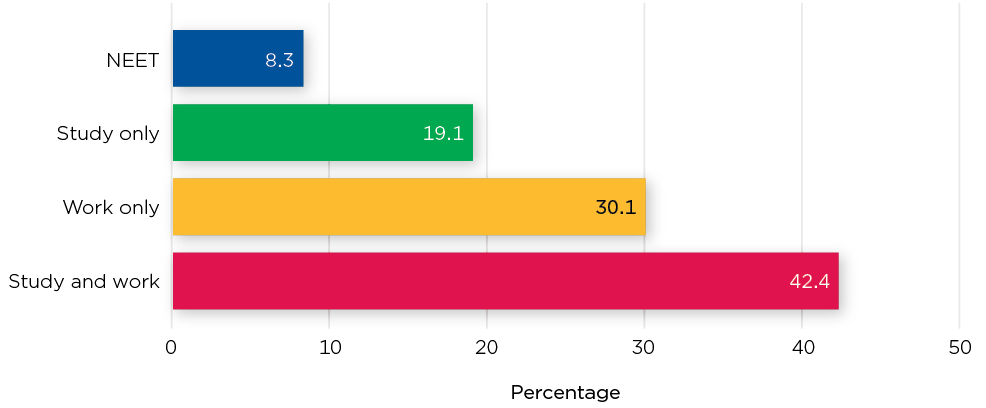

How prevalent is NEET among adolescents?

At age 18-19, around 1 in 12 (8%) of LSAC adolescents were not engaged in education, employment or training (Figure 2). Participation in either (or both) education and employment were common; 19% of adolescents were studying only, 30% were working only, and more than 40% were both studying and working.3

Figure 2: Percentage of LSAC adolescents in work and/or studying at age 18-19

Notes: Values are unweighted. (n = 2,671)

Source: LSAC survey data at Wave 8

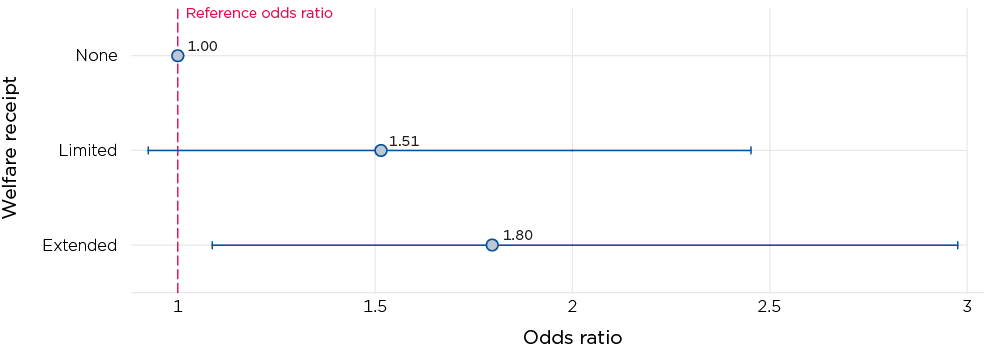

Associations between parental welfare receipt and child's NEET status

Parental welfare receipt was associated with an increased likelihood of adolescents being NEET at age 18-19 (Figure 3). This finding accounts for a variety of adolescent, parent and environmental characteristics that may be relevant to NEET status (described further in the Supplementary Material).4 Compared with adolescents whose primary parent did not receive any welfare payments, those whose parents had extended receipt of welfare faced 80% increased odds (a greater likelihood) of being NEET. Adolescents whose primary parent received limited payments had 51% increased odds of being NEET - albeit with lower statistical confidence.

Other personal, socio-economic and household factors were also associated with being NEET at age 18-19:

- Males were more likely to be NEET than females; the odds were 43% lower among females.

- LSAC adolescents in fair or poor health (corresponding to 1 in 20 individuals) faced over twice the odds of being NEET compared to those who reported good or better health. Those with poorer mental health (measured through emotional difficulties) had 77% higher odds of being NEET than those who did not.

- Compared to adolescents residing in areas with relatively low educational and occupational levels, those in high education/occupation level neighbourhoods faced 49% lower odds of being NEET.

These results indicate that an adolescent's circumstances - including those often beyond their control - can be strongly related to their engagement in education, employment and training.

Figure 3: Correlations between welfare receipt and NEET status

Notes: Odds ratios from estimated logit model reported in Table S1 within Supplementary Material. Lines indicate 95% confidence intervals. Values are unweighted. (n = 2,037)

Relevance for policy and practice

This snapshot shows that children who grow up with a parent receiving welfare payments (especially for longer total durations) are themselves at risk of not being in education, employment or training at age 18-19. This finding presents several implications for Australian policy and practice.

Young Australians face a challenging transition from school to work:

- In 2020, the proportion of NEET Australians aged 15-19 (7.4%) is similar to the OECD average (6.9%).

- Young adulthood is a critical stage of the life course often featuring major changes to family (moving out of home, finding a partner, having children) and career (further studies, beginning employment).

- Risks of being NEET are elevated with other conditions of disadvantage. There are opportunities to target policies and assistance to communities with relatively lower educational and occupational levels. Beyond any direct benefits, there could be indirect benefits to children growing up in these areas through reducing risks of NEET at early adulthood.

The intergenerational transmission of disadvantage persists despite substantial spending on welfare payments:

- In 2019/20, federal and state government spending on families and children and unemployed people totalled $56.6 billion

- The risks to being NEET are particularly elevated in families with extended welfare receipt. Policies that holistically address the underlying disadvantage in these families have the greatest potential to improve social mobility and halt intergenerational cycles of disadvantage.

Potential of the Growing Up in Australia study

LSAC provides recent longitudinal data that are instrumental in understanding intergenerational social mobility and the efficacy of Australian policies aimed at addressing disadvantage. Identifying modifiable factors that can impact education and employment outcomes among young Australians helps to inform and shape policies for young Australians by highlighting prime opportunities for assistance and intervention. The ongoing nature of LSAC since 2004 provides a unique opportunity to examine and identify targets for prevention and early intervention.

Specific research questions or areas to answer and investigate using LSAC data might include:

- Does parental welfare receipt affect earlier educational outcomes among young Australians, such as academic achievement and schooling/course completion?

- Are the adverse consequences of parental welfare receipt dependent on the life course stage of the child (early childhood, adolescence or young adulthood)?

- How are welfare payments assisting families, when distinguished from the underlying disadvantage that they face? Causal estimates that separate the benefits of welfare payments from the recipient's background of disadvantage can improve our understanding of how effective these policies are.

- Is the association between parental welfare receipt and adolescent education/employment outcomes moderated by schooling or parenting factors? If so, what are the policy opportunities to better assist families who receive welfare payments?

- What might be the contributing factors to the lower rates of NEET status among young women?

- Does the quality of housing (e.g. stable or affordable housing) factor into adolescent education/employment outcomes? What do these outcomes look like for adolescents who experience family violence?

- Whether certain policy decisions or initiatives, such as the Cashless Debit Card or Mutual obligations requirements, affect the receipt of welfare among Australian parents. Changes to who receives and how welfare payments are administered may also change how effective these payments are in assisting disadvantaged families. Evaluation of other initiatives, including those yet to be introduced, is also possible as more recent Centrelink data become available.

- Are there other adverse longer-term employment outcomes or specific trajectories associated with (limited/extended) welfare receipt, including high job turnover during and following young adulthood?

Further details

Technical details of this research, including description of measures, detailed results and bibliography are available to download as a PDF [366 KB]

About the Growing Up in Australia snapshot series

Growing Up in Australia snapshots are brief and accessible summaries of policy-relevant research findings from Growing Up in Australia: The Longitudinal Study of Australian Children (LSAC). View other Growing Up in Australia snapshots in this series.

1 The cited research is listed in the Supplementary Material.

2 For this reason Carer Payments and Disability Support Pension are not in focus for this snapshot, as the underlying circumstances can be expected to endure over a longer period. These payments are received by a minority of 12% and 8% of primary parent welfare recipients.

3 Some young Australians take a 'gap year' after completing schooling, which may involve neither study nor work activities. There is little evidence that gap years influence the analysis in this snapshot; further explanation is provided in the Supplementary Material.

4 Full model results are presented under Table S1 in the Supplementary Material, which also outlines other individual and environmental factors that were associated with NEET status.

5 Dr Tracy Evans-Whipp and Dr Bosco Rowland were editors as part of this series but no longer work at AIFS at the time of publication.

Acknowledgements

Authors: Dr Clement Wong, Dr Brendan Quinn, Br Bosco Rowland and Dr Lisa Mundy

Series editors:5 Dr Tracy Evans-Whipp, Dr Bosco Rowland and Dr Lisa Mundy

Copy editor: Katharine Day

Graphic design: Lisa Carroll

This snapshot benefited from academic contributions from Jennifer Prattley, Tracy Evans-Whipp and Chris Schilling.

This snapshot was updated on 30 October 2023 to include a fourth author.

This research would not have been possible without the invaluable contributions of the Growing Up in Australia children and their families.

Website: growingupinaustralia.gov.au

Email: [email protected]

The study is a partnership between the Department of Social Services and the Australian Institute of Family Studies, and is advised by a consortium of leading Australian academics. The Australian Bureau of Statistics were also partners of the study until 2022, with Roy Morgan joining at this point. Findings and views expressed in this publication are those of the individual authors and may not reflect those of the Australian Institute of Family Studies, the Department of Social Services, the Australian Bureau of Statistics or Roy Morgan.

Featured image: © GettyImages/Mixmike

Publication details

Wong, C., Quinn, B., Rowland, B., & Mundy, L. (2023). Parents' welfare receipt and their children's employment and education outcomes (Growing Up in Australia Snapshot Series - Issue 10). Melbourne: Australian Institute of Family Studies.